This article is about cannabis. But for a moment, let yourself be transported to Napa Valley.

Where picturesque vines grow effortlessly up regal mountains. A hawk hangs in the air watching as tourists take photos.

Now, imagine if every vine on those romantic rolling hills was tagged, and every grape tracked from seed to sale.

Expand that to the rest of California, which produces more wine than any other state, and it would mean tracking grapes that go into 270 million twelve-bottle cases of wine annually.

Forget about romance and mystique. The industry as we know it would come to a crippling halt.

Plant by plant tracking takes time, resources and money. But it's not just the farmers, wineries, retailers and consumers of this $25 billion industry who would suffer.

The economy would be at a loss. Regulators would be inundated with data. Tourism would slow.

An already highly regulated system that works would be thrown out in favor of an inefficient plan. From seed to sale and plant by plant, we'd take apart a vibrant part of the California economy.

This is exactly what is being proposed for cannabis in California, where onerous regulations from smaller cannabis-producing states like Colorado are being considered for the blueprint.

We believe that if seed to sale regulations from states like Colorado are used as the boilerplate for California cannabis traceability, the state — and not just the cannabis industry — will suffer.

Cannabis is King in California

Cannabis is crucial to the Californian economy.

Casey and Amber O'Neill from HappyDay Farms in Mendocino County, California

In 2006 it was estimated by Jon Gettman that California produced nearly 40% of all cannabis in the US, making it the largest producer of cannabis in the nation.

That's $14 billion worth of cannabis, or 22 million plants yielding 8.6 million production pounds.

Based on more recent assumptions from enforcement agencies, the California Growers Association (CGA) estimates retail sales could be as high as $16–32 billion.

If even the lower estimate of $16 billion (up from $14 billion in 2006) is correct, that means the retail sales value of cannabis in California is more than the 2014 sales value of California's top two commodities — Milk ($9.4 billion) and Almonds ($5.9 billion) — combined.

The retail value of cannabis in California is more than the 2014 sales value of California's top two commodities combined.

According to Gettman's study, cannabis was already the top cash crop in California back in 2006. And that was before the major growth and evolution this industry has gone through in the last ten years.

The pure scale of this already developed business in California is exactly why the decision on track and trace regulations must not be taken lightly.

An overly-complex system could keep businesses operating in the black market and push others into the illicit trade.

Regulations done right, however, would provide even more tax dollars as operators who once practiced in the black market turned to legal production.

Existing Traceability Regulations

Although no product truly compares to medicinal and recreational cannabis, alcohol is also highly regulated and made from agricultural products.

Wine grapes, for example, are tracked by varietal/ton for proper taxation and depending on the product's terroir and estate claims, by blocks/vineyards.

Why track cannabis by seed and plant then?

Though legal in 23 states plus DC, because cannabis is federally classified as an illicit schedule 1 drug, state regulations tend to err on the side of caution.

These tight regulations stemming from the treatment of cannabis as a schedule 1 drug are only compounded by fears of taxes lost to the black market.

Add to that concerns about potentially contaminated product and potential recalls, and thus the birth of excessively cautious traceability regulations.

Ahead of the curve on legalization of recreational cannabis after it was approved in a November 2012 ballot, Colorado began using its seed to sale tracking methodology in December 2013.

This tracking methodology was created by the Marijuana Enforcement Division, a part of the Department of Revenue's Enforcement Division.

The system used by Colorado, called Marijuana Enforcement Tracking Reporting Compliance (Metrc), requires each plant and product to have an Radio Frequency Identification (RFID) tag that can be scanned by an RFID gun.

The unique RFID tags on plants and products are what enable tracking from seed to sale by individual plant.

RFID tracking at a Colorado indoor grow

As you can imagine, this method of tracking doesn't come cheap. Plant tags are 45 cents each and product packaging tags are a quarter per tag.

To give some perspective, the alternative to RFID chips, barcodes, cost only 2 cents.

In addition to the cost of tags, to be compliant each business that touches cannabis in Colorado must have professionals devoted to ensure tracking compliance.

Yet using RFID with cannabis has proven tricky.

According to Neal Levine, Senior Vice President of Government Affairs at LivWell Enlightened Health, RFID tracking of cannabis in Colorado has been ineffective in their experience.

"In facilities of any significant size, RFID tracking technology is inexact with a substantial failure rate to begin with. When you add it to an environment that is dirty and wet, like a cannabis grow, the failure rate only increases," he says.

"In a regulatory environment where we must track every plant, an inexact technology like RFID is a costly and poor solution." — Neal Levine

Look to other industries and there are plenty of examples of RFID failing, the most famous of which is Walmart.

As Walmart raced to set up its RFID program, it was faced with technical problems and suppliers who didn't want to participate.

If the king of retail, efficiency and scale can't nail it, how can the state of California?

California isn't Colorado…Or India…Russia…Or Canada

Though we like cookies, a cookie cutter approach for traceability seems half baked.

After all, California is a truly special place, touting the 8th largest economy in the world.

With a GDP larger than Italy's, India's, and Russia's, California is like its own country. And this country knows how to do agriculture right.

California is the breadbasket of the nation. Two-thirds of US fruit and nuts and more than a third of the country's vegetables are grown here in California.

In 2014 we produced a record $53.5 billion in sales of agricultural products (not including cannabis).

Why, then, are we being compared to Colorado? California is not Colorado.

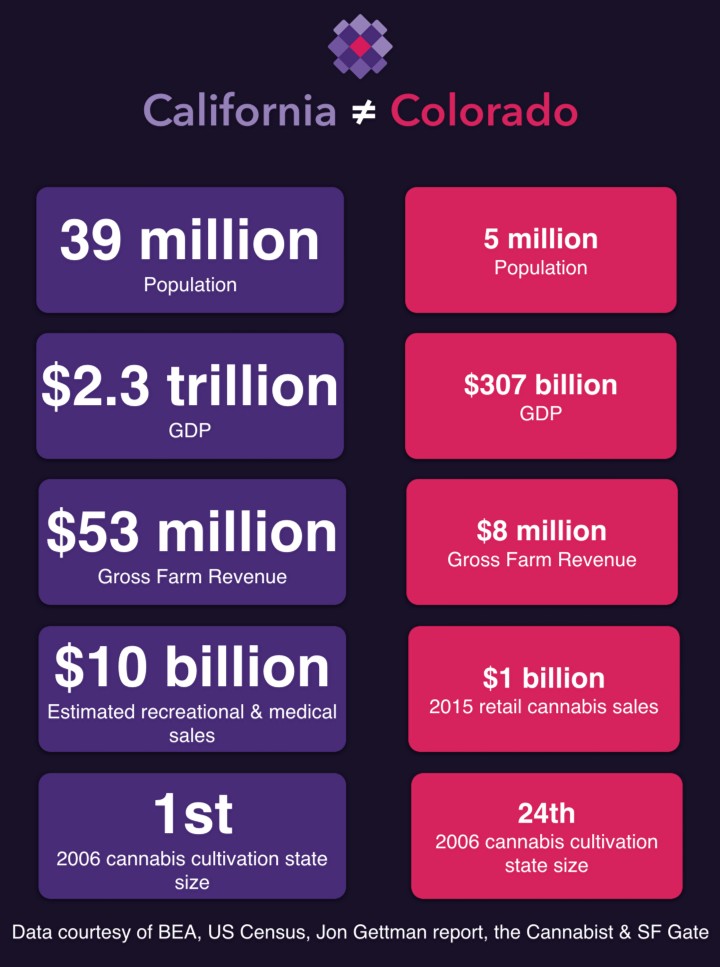

While California had a whopping estimated population of 39 million in 2014, Colorado was home to about 5 million.

With the largest GDP of any state, California made up 2.3 trillion dollars of the 2014 US economy compared to 307 billion dollars in Colorado.

We've been growing agricultural products and producing wine with massive scale for centuries. We know how to grow.

And California is the most experienced state when it comes to standards on water, energy efficiency, and issues like GMO.

California also has more experience than any other state when it comes to Cannabis, which it legalized for medical use before any other state in 1996 as part of Proposition 215 Compassionate Use Act.

Just as California was the largest cannabis growing state in 2006, Colorado was the 24th largest cultivator, with 290 thousand plants, 79 thousand pounds and $127 million in value.

Though Colorado now has closer to 3 million licensed plants, it still pales in comparison to California's 22-plus million (licensed and unlicensed).

As for retail sales, Colorado stores sold nearly $1 billion in recreational and medical cannabis in 2015.

California retail sales are estimated to be ten times that if recreational cannabis is legalized.

At an estimated $10 billion in retail sales, California would dwarf Colorado in retail cannabis sales.

The Future of Cannabis Tracking in California

The Metrc track and trace system in Colorado has registered over 11 thousand users, more than 3 million plants and 2 million products.

How is California expected to replicate that same process for over 22 million plants and — according to the California Growers Association — an estimated 50 thousand farmers? Not to mention all the product producers, distributors, retailers and delivery services.

Farmers with Nikki and Swami at Swami Select Farm in Mendocino County

Farmers with Nikki and Swami at Swami Select Farm in Mendocino County

Monitoring the buds, leaves and plants from over 22 million cannabis plants would cost the state and its businesses millions of dollars and man-hours. Even finding a data warehouse of that size would be a difficult feat.

This excessive monitoring would send legal producers into the black market, keep others in the illicit trade and drive up cost of drug enforcement.

The problem with how we're thinking about tracking cannabis is a one size fits all approach.

Let's not take existing systems that aren't working and apply them to the largest cannabis producing state in the nation.

This article was originally published by Meadow here.

To learn more about Meadow, check us out on Facebook, Twitter and getmeadow.com.